What Does It Mean When Taxes Are Sold . The date of purchase or acquisition. Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. There are two common types of tax sales: It’s also known as a foreclosure auction. Tax deed sales and tax lien. Web the type of property sold or disposed of. Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. Once sold, the property is then transferred to the purchaser. Web sep 16, 2024, 05:00 am. The property is a residential property. Web a tax sale occurs when property owners are delinquent on their property tax payments.

from marketbusinessnews.com

Once sold, the property is then transferred to the purchaser. The property is a residential property. Web sep 16, 2024, 05:00 am. Web a tax sale occurs when property owners are delinquent on their property tax payments. Tax deed sales and tax lien. Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. Web the type of property sold or disposed of. There are two common types of tax sales: Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. The date of purchase or acquisition.

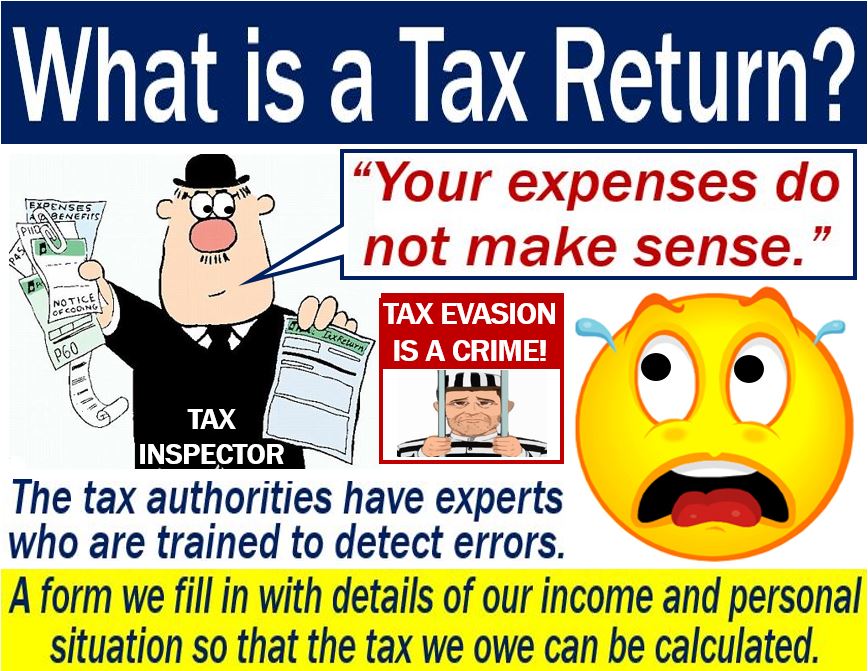

What is a tax return? Purpose of a tax return Market Business News

What Does It Mean When Taxes Are Sold Web a tax sale occurs when property owners are delinquent on their property tax payments. Web the type of property sold or disposed of. There are two common types of tax sales: Once sold, the property is then transferred to the purchaser. The date of purchase or acquisition. Web sep 16, 2024, 05:00 am. Tax deed sales and tax lien. Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. The property is a residential property. It’s also known as a foreclosure auction. Web a tax sale occurs when property owners are delinquent on their property tax payments.

From texasscorecard.com

Commentary How Property Taxes Work Texas Scorecard What Does It Mean When Taxes Are Sold Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. Tax deed sales and tax lien. Once sold, the property is then transferred to the purchaser. The property is a residential property. It’s also known as a foreclosure auction. Web a tax deed gives the government agency. What Does It Mean When Taxes Are Sold.

From swanwealth.com

Estate Tax Loss Swan Wealth What Does It Mean When Taxes Are Sold Tax deed sales and tax lien. Once sold, the property is then transferred to the purchaser. It’s also known as a foreclosure auction. Web the type of property sold or disposed of. The date of purchase or acquisition. There are two common types of tax sales: Web a tax deed gives the government agency the authority to sell the property. What Does It Mean When Taxes Are Sold.

From www.weteachhouses.com

Can a house be sold with back taxes due? We Teach Houses What Does It Mean When Taxes Are Sold The date of purchase or acquisition. Once sold, the property is then transferred to the purchaser. Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. Web sep 16, 2024, 05:00 am. The property is a residential property. Web a tax sale occurs when property owners are. What Does It Mean When Taxes Are Sold.

From www.zoho.com

What is an invoice? Definition, purpose, examples Essential What Does It Mean When Taxes Are Sold There are two common types of tax sales: Tax deed sales and tax lien. Web the type of property sold or disposed of. Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. It’s also known as a foreclosure auction. The date of purchase or acquisition. The. What Does It Mean When Taxes Are Sold.

From bearswire.usatoday.com

What does Supreme Court sales tax ruling mean for South Dakota? What Does It Mean When Taxes Are Sold Once sold, the property is then transferred to the purchaser. Web the type of property sold or disposed of. There are two common types of tax sales: The property is a residential property. It’s also known as a foreclosure auction. Tax deed sales and tax lien. Web a tax deed gives the government agency the authority to sell the property. What Does It Mean When Taxes Are Sold.

From www.slideshare.net

The Charge to Tax on What Does It Mean When Taxes Are Sold Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. The property is a residential property. Web the type of property sold or disposed of. Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. Web a tax. What Does It Mean When Taxes Are Sold.

From www.dreamstime.com

Pay Your Taxes stock photo. Image of holding, background 55315564 What Does It Mean When Taxes Are Sold Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. Once sold, the property is then transferred to the purchaser. Web the type of property sold or disposed of. Web a tax sale occurs when property owners are delinquent on their property tax payments. The property is a residential property. It’s. What Does It Mean When Taxes Are Sold.

From www.moneymagpie.com

Tax Credits Made Easy What Does It Mean When Taxes Are Sold Tax deed sales and tax lien. It’s also known as a foreclosure auction. Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. The date of purchase or acquisition. Once sold, the property is then transferred to the purchaser. There are two common types of tax sales:. What Does It Mean When Taxes Are Sold.

From www.cuemath.com

How to calculate taxes and discounts Basic Concept, Formulas and What Does It Mean When Taxes Are Sold There are two common types of tax sales: Tax deed sales and tax lien. Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. The property is a residential property. Web the type of property sold or disposed of. Web the property at a tax deed sale is usually sold for. What Does It Mean When Taxes Are Sold.

From somethingborrowedpdx.com

How To Sell Gold Without Paying Taxes? What Does It Mean When Taxes Are Sold Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. The property is a residential property. Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. Web sep 16, 2024, 05:00 am. The date of purchase or acquisition.. What Does It Mean When Taxes Are Sold.

From tessmorefinance.blogspot.com

What Is Short Selling? A Simplified Guide on How To Short a Stock What Does It Mean When Taxes Are Sold The date of purchase or acquisition. Once sold, the property is then transferred to the purchaser. Web sep 16, 2024, 05:00 am. Tax deed sales and tax lien. The property is a residential property. There are two common types of tax sales: Web the type of property sold or disposed of. Web a tax sale occurs when property owners are. What Does It Mean When Taxes Are Sold.

From listwithclever.com

How to Avoid Taxes When You Sell a Rental Property What Does It Mean When Taxes Are Sold Once sold, the property is then transferred to the purchaser. The date of purchase or acquisition. There are two common types of tax sales: It’s also known as a foreclosure auction. Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. Web a tax sale occurs when property owners are delinquent. What Does It Mean When Taxes Are Sold.

From www.youtube.com

DO I HAVE TO PAY TAXES WHEN I SELL STOCKS? TAX BASICS FOR STOCK What Does It Mean When Taxes Are Sold The property is a residential property. There are two common types of tax sales: It’s also known as a foreclosure auction. Once sold, the property is then transferred to the purchaser. The date of purchase or acquisition. Tax deed sales and tax lien. Web a tax sale occurs when property owners are delinquent on their property tax payments. Web the. What Does It Mean When Taxes Are Sold.

From bronx.news12.com

9 tips to help you file your federal taxes What Does It Mean When Taxes Are Sold Web a tax deed gives the government agency the authority to sell the property to collect the delinquent taxes. There are two common types of tax sales: Web a tax sale occurs when property owners are delinquent on their property tax payments. The date of purchase or acquisition. Web the type of property sold or disposed of. The property is. What Does It Mean When Taxes Are Sold.

From taxwalls.blogspot.com

How Much Tax Do You Pay On House Sale Tax Walls What Does It Mean When Taxes Are Sold The date of purchase or acquisition. There are two common types of tax sales: It’s also known as a foreclosure auction. The property is a residential property. Web the type of property sold or disposed of. Once sold, the property is then transferred to the purchaser. Web a tax deed gives the government agency the authority to sell the property. What Does It Mean When Taxes Are Sold.

From wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax What Does It Mean When Taxes Are Sold Once sold, the property is then transferred to the purchaser. Web sep 16, 2024, 05:00 am. It’s also known as a foreclosure auction. There are two common types of tax sales: Web a tax sale occurs when property owners are delinquent on their property tax payments. Web a tax deed gives the government agency the authority to sell the property. What Does It Mean When Taxes Are Sold.

From caldesul.com.br

What Is Matched Betting & How Does It Work? What Does It Mean When Taxes Are Sold Web the property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges. Tax deed sales and tax lien. The date of purchase or acquisition. The property is a residential property. There are two common types of tax sales: It’s also known as a foreclosure auction. Web a tax sale. What Does It Mean When Taxes Are Sold.

From www.stessa.com

How Much Tax Do You Pay When You Sell a Rental Property? What Does It Mean When Taxes Are Sold Web sep 16, 2024, 05:00 am. Web a tax sale occurs when property owners are delinquent on their property tax payments. Tax deed sales and tax lien. There are two common types of tax sales: It’s also known as a foreclosure auction. Web the type of property sold or disposed of. Once sold, the property is then transferred to the. What Does It Mean When Taxes Are Sold.